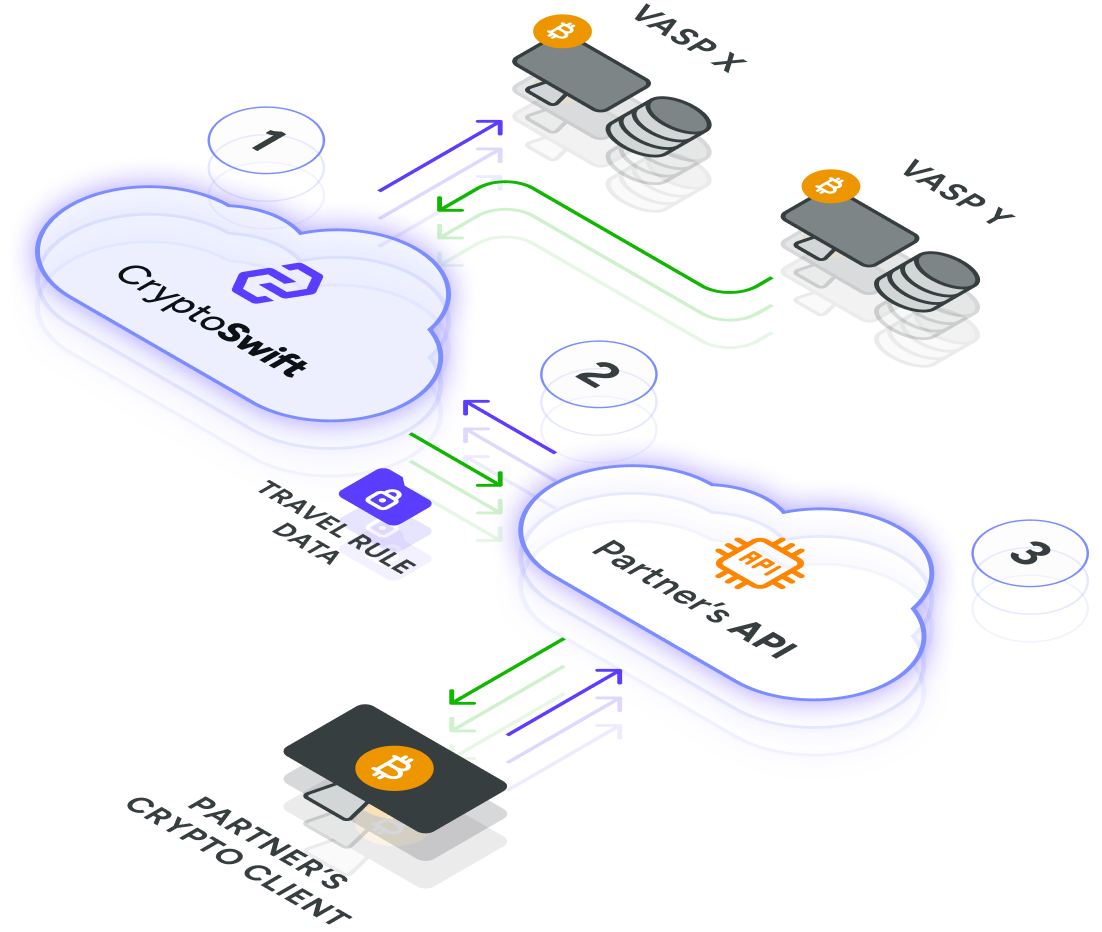

Travel Rule Infrastructure for Compliance Providers

Integrate CryptoSwift into your compliance platform and offer fully compliant Travel Rule messaging to your VASP customers. Whether you are a blockchain analytics provider, KYC/KYT platform, or a crypto compliance service, our Partner API allows you to integrate and resell CryptoSwift as part of your existing solution.

Register new clients via our Partner API.

Proxy our API and manage Travel Rule transactions on behalf of your clients.

Bundle Travel Rule compliance into your existing product or premium service plan.

Brands we’ve partnered with

Why Partner with CryptoSwift?

A Fully Managed Travel Rule Solution for Your Customers – Ready for Use Today.

Partnering with CryptoSwift

- Deliver a Complete Compliance Solution

Your customers require Travel Rule compliance and prefer a unified platform. By integrating CryptoSwift, you enhance your offering and streamline compliance for your VASP clients. - Effortless API Integration

Our Partner API is designed for quick deployment, requiring minimal engineering effort while delivering full compliance functionality out of the box. - Compliance Managed for You

CryptoSwift ensures full Travel Rule compliance, allowing you to focus on your core product without the complexities of regulatory management. - Scalable for Any Business Size

From startups to large enterprises, our solution grows with your business, supporting compliance at every stage.

Pricing & Business Model

Revenue Share Model Tailored for Partners

Revenue share model

Our partnership operates on a revenue-sharing basis, allowing you to monetize Travel Rule compliance by reselling CryptoSwift’s infrastructure.

Flexible Pricing Options

Depending on the integration type and client profile, pricing can follow our standard model or be tailored to meet specific partner needs in more complex cases.

Book a demo to find out more about our pricing options

Built for developers

Fast-Track Travel Rule Compliance for Your Customers using our API

Provide Travel Rule Compliance Faster with Our Simple and Efficient API.

Integrate CryptoSwift’s API to enable Travel Rule compliance for your customers with minimal development effort. Our API is built for efficiency, allowing you to focus on your core business while we handle compliance complexities.

- Dedicated Partner API – Fully automated registration and management of new end clients. Proxy all CryptoSwift API calls through the Partner API.

- Plug & Play Compliance – Easily embed Travel Rule compliance into your AML/KYC solutions, supported by our OpenAPI/Swagger-based documentation.

curl --location 'http://api.cryptoswift.eu/partner/register' \

--header 'x-partner-api-key: 4c357d8dx-8egg-3cvr-b909-2f569e98f2c9' \

--header 'Content-Type: application/json' \

--data-raw '{

"name": "CryptoX",

"email": "support@cryptox.domain"

}' Frequently Asked Questions

What is the Crypto Travel Rule?

The Crypto Travel Rule, introduced by the Financial Action Task Force (FATF), requires Virtual Asset Service Providers (VASPs) to share specific customer information when transferring virtual assets between entities. This rule aims to combat money laundering and terrorist financing by improving transparency in crypto transactions.Who must comply with the Travel Rule?

VASPs, including cryptocurrency exchanges, wallet providers, and financial institutions handling virtual asset transactions, must comply. Compliance depends on the jurisdiction, but it generally applies to entities transferring cryptocurrencies above a specific threshold. In the European Union, under the MiCA regulation, there is a 0 EUR threshold, meaning all transfers are subject to the Travel Rule, regardless of the transaction amount.What customer information must be shared under the Travel Rule?

Under the Travel Rule, VASPs must transmit the following information for transactions:-

- Originator Information:

-

- Name

-

- Account number (or unique transaction identifier)

-

- Physical address or national identity number (depending on jurisdiction)

-

- Originator Information:

-

- Beneficiary Information:

-

- Name

-

- Account number (or wallet address)

-

- Beneficiary Information:

How does the Travel Rule impact crypto exchanges and banks?

-

- Data Collection: Ensuring accurate customer information is collected during onboarding and transactions.

-

- Secure Transmission: Exchanging customer information securely between counterparties.

-

- Transaction Monitoring: Identifying and flagging suspicious transactions for further investigation.

What are the technical challenges of implementing the Travel Rule?

-

- Interoperability: Ensuring compatibility between various Travel Rule protocols.

-

- Data Privacy: Balancing regulatory compliance with customer data protection requirements under GDPR or similar regulations.

-

- Real-Time Compliance: Transmitting data in real time without impacting transaction speed or user experience.

-

- Counterparty Verification: Ensuring the receiving VASP is legitimate and compliant.

What solutions does CryptoSwift.eu offer for Travel Rule compliance?

-

- Interoperable Protocols: Seamless integration with leading Travel Rule networks and protocols. Integrate once and we do the rest.

-

- Data Encryption: End-to-end encrypted data transmission to protect sensitive customer information.

-

- Real-Time Processing: Ensuring rapid, secure exchange of required data without transaction delays.

-

- Regulatory Expertise: Up-to-date compliance with evolving FATF guidance, MiCA regulations, and regional differences.

Is the Travel Rule only for international transactions?

What is the threshold for Travel Rule applicability?

Does the Travel Rule apply to DeFi transactions?

How does the Travel Rule align with GDPR and data privacy laws?

-

- Minimizing the data collected and transmitted.

-

- Using encryption to secure sensitive information.

-

- Adhering to jurisdictional privacy laws while maintaining transparency for regulators.

What protocols are available for Travel Rule compliance?

How can I start implementing the Travel Rule in my organization?

-

- Conduct a gap analysis of your current compliance processes.

-

- Choose a Travel Rule solution provider, like CryptoSwift.eu, that aligns with your operational needs.

-

- Integrate the chosen protocol into your transaction workflows.

-

- Train your compliance and technical teams on the new processes.

-

- Monitor and adapt to regulatory changes.

How can CryptoSwift.eu help me stay ahead of regulatory changes?

Can I test CryptoSwift.eu’s Travel Rule solution before full integration?

-

- Simulate Travel Rule transactions.

-

- Validate data security and accuracy.

-

- Ensure interoperability with counterparties before live deployment.