The last few months at CryptoSwift have been intense in a good way. One of the most exciting developments has been our work on improving the Travel Rule risk score. Here’s What’s New at CryptoSwift.

We’ve shipped a lot. Enough that I had to think twice about whether this should be one blog post or three. But I’ll try to keep it structured and readable.

As always, we build for one reason only: to make CryptoSwift the best and easiest-to-use Travel Rule solution on the market. The one that works when compliance teams and developers need it to.

Let’s start with the biggest one.

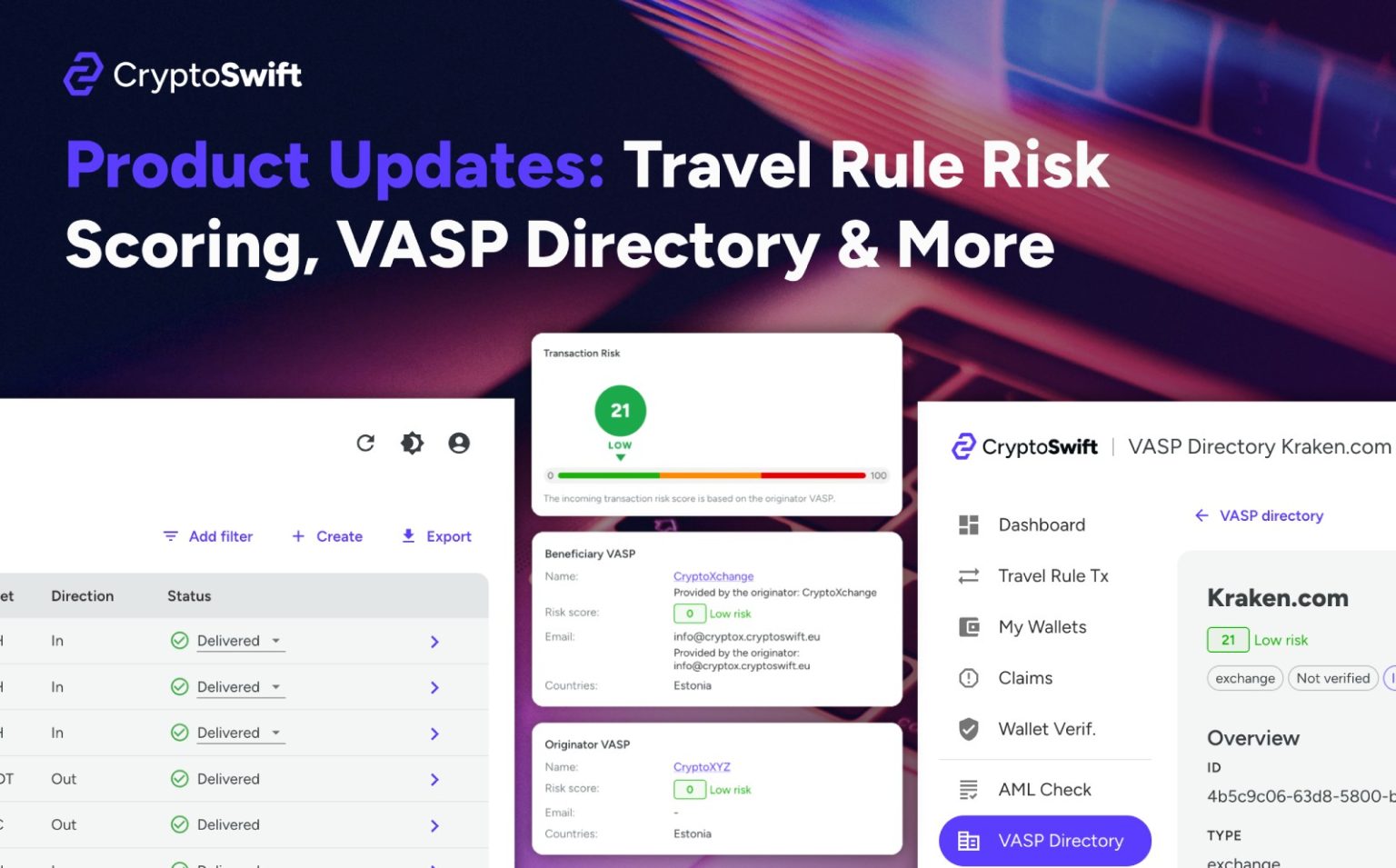

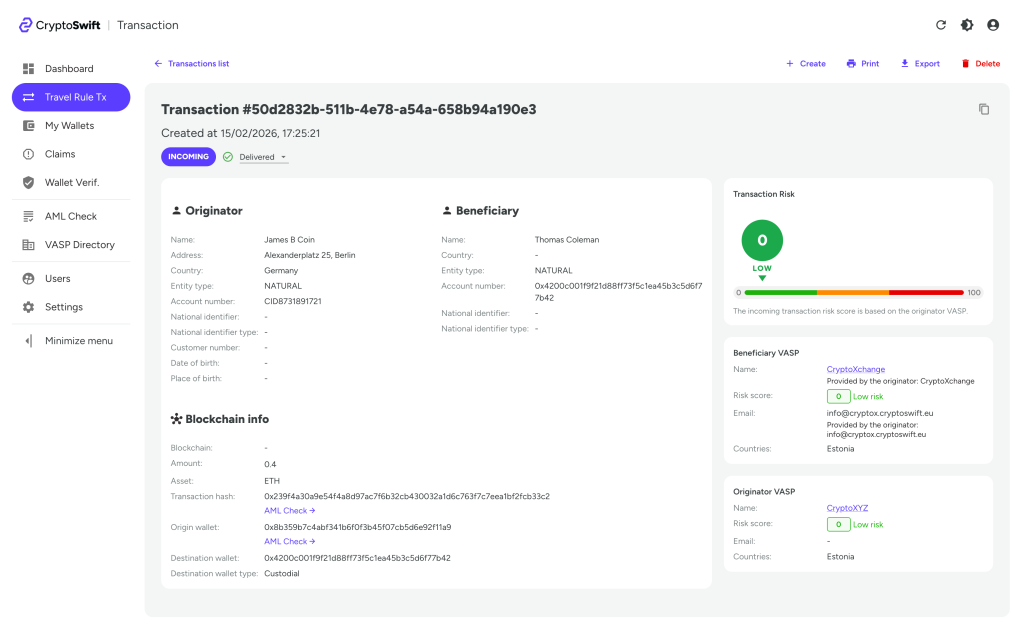

Travel Rule Risk Score – Real-Time Risk Intelligence

We’ve added a risk score to every incoming and outgoing Travel Rule message. This might sound like a small feature, but it isn’t.

From now on, every Travel Rule message created in CryptoSwift is enriched with a transaction risk score calculated using the AML/KYT providers we already trust internally for VASP and wallet address scoring.

The logic is straightforward:

- For incoming transactions, we calculate the risk based on the originator VASP.

- For outgoing transactions, we use the beneficiary VASP risk score.

- If the beneficiary VASP cannot be immediately identified, we fall back to the destination wallet risk score.

No guessing or black magic, just structured risk assessment based on real data.

For outgoing transactions, the risk score and severity are returned immediately when the Travel Rule message is created. This makes pre-transaction flows much more powerful.

If you send the Travel Rule message before broadcasting the on-chain transaction, you can now decide:

- Do we proceed?

- Do we mark this for manual review?

- Do we stop it completely?

All before funds move.

If you operate in a post-transaction model, the risk score still gives AML officers structured data to assess customer behaviour and keep proper audit trails. It also allows for automation, because no one wants a compliance team manually checking everything in 2026.

For incoming transactions, the risk score is also included in the Travel Rule payload itself. That means you can automate deposit release flows. Low risk? Auto-credit. Higher risk? Escalate. Very high risk? Block and investigate.

The risk score is available via API and inside the Client Dashboard.

The VASP Directory

Compliance teams are constantly interested in the same questions:

Who is this counterparty?

Are they regulated?

What jurisdictions do they operate in?

What’s their risk profile?

To address these questions, we built a proper VASP Directory inside CryptoSwift. It currently contains data on over 12,000 crypto service providers globally. For each VASP, you can see:

- Risk score

- MiCA compliance status

- Countries of registration

- Contact information

- Whether they are part of the CryptoSwift network

But the important part is not the list itself. The directory is deeply integrated with the rest of our platform. When you send or receive a Travel Rule message, originator and beneficiary VASPs are automatically linked. Risk scores connect directly and everything is cross-referenced.

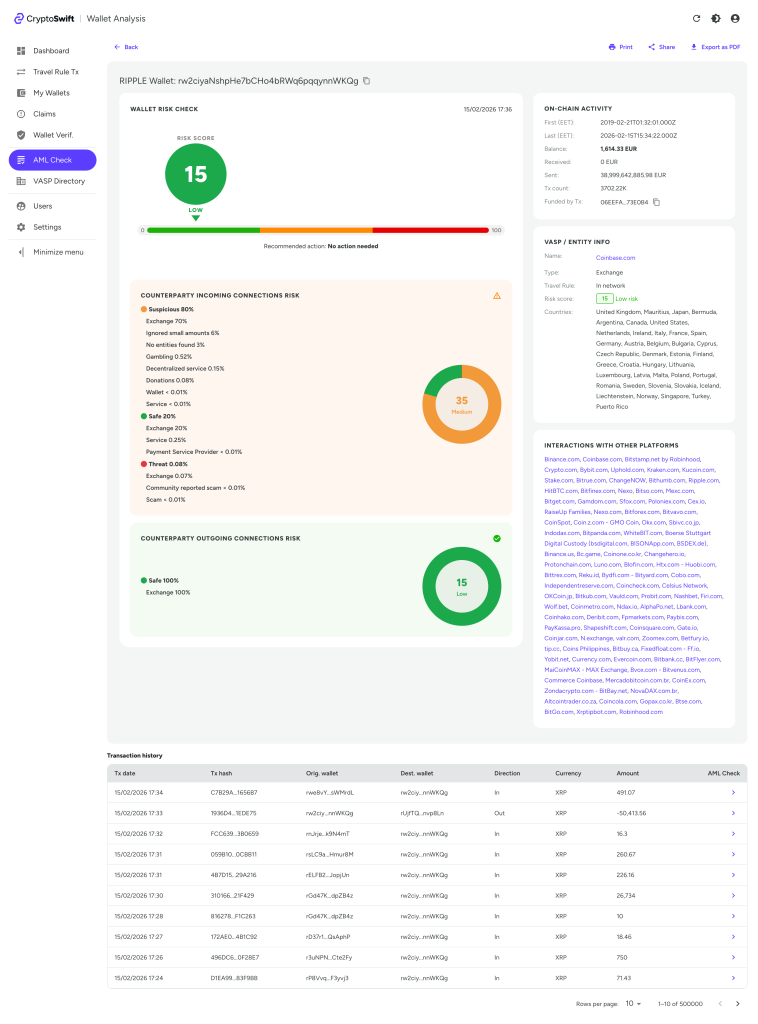

AML Checks

On top of the Travel Rule risk score, we added full AML checks for wallet addresses and transactions inside the Client Dashboard.

You can bring your own AML provider API key if you already have a contract. Or you can obtain an AML package via CryptoSwift.

Right now, we’re integrated with Scorechain. More providers are being added based on customer demand. If your compliance team prefers a specific vendor, tell us. We’ll integrate it.

The goal is simple: eliminate fragmentation.

You shouldn’t need one system for Travel Rule, another for wallet checks, and a third for VASP data. Everything should work together. In CryptoSwift, it now does.

AML checks link directly with Travel Rule messages and the VASP directory. That means less copy-paste, fewer context switches, and cleaner audit trails.

Wallet Verification – More Flexible & Practical

We’ve also significantly improved our self-hosted wallet verification widget and API.

This includes support for video files in visual proof flows (yes, sometimes pictures aren’t enough), more customization options, on-chain testing capabilities, and improved multi-chain support.

We strongly believe this is currently the most flexible and developer-friendly self-hosted wallet verification solution on the market.

Dashboard Improvements

We’ve continued polishing the Client Dashboard. Clearer layouts, better visibility of transaction risk, improved workflows.

Compliance is already complex, the interface shouldn’t add friction.

Small UX improvements compound over time. Fewer clicks, clearer risk indicators, faster reviews.

Developer Portal 2.0

We also completely revamped our Developer Portal:

It’s no longer just technical API documentation. It now includes structured compliance workflow descriptions that help you design Travel Rule flows correctly from day one.

Because the hardest part of Travel Rule implementation isn’t the API call. It’s understanding how to structure compliant flows without ruining user experience.

We’ve documented those patterns clearly so teams don’t have to reinvent them.

Better Partner Support

Finally, we improved documentation and guides specifically for our partners: compliance companies reselling our infrastructure and other Travel Rule networks integrating with us.

Clearer onboarding, better API documentation, faster integrations: we want our partners to succeed.

Why So Much at Once?

We’ve been heads down building and prefer shipping working features over announcing roadmaps.

Everything described here has one objective: to make CryptoSwift the best and easiest-to-use Travel Rule infrastructure provider in the market.

➜ Less friction for developers.

➜ More control for compliance officers.

➜ More automation everywhere.

We’re not slowing down.