Understanding the Travel Rule

The Travel Rule is a regulatory measure designed to combat money laundering and terrorism financing. Developed by the Financial Action Task Force (FATF), this rule requires Virtual Asset Service Providers (VASPs) to collect and share specific information about transaction originators and beneficiaries. It’s a vital part of global efforts to ensure transparency and security in financial dealings.

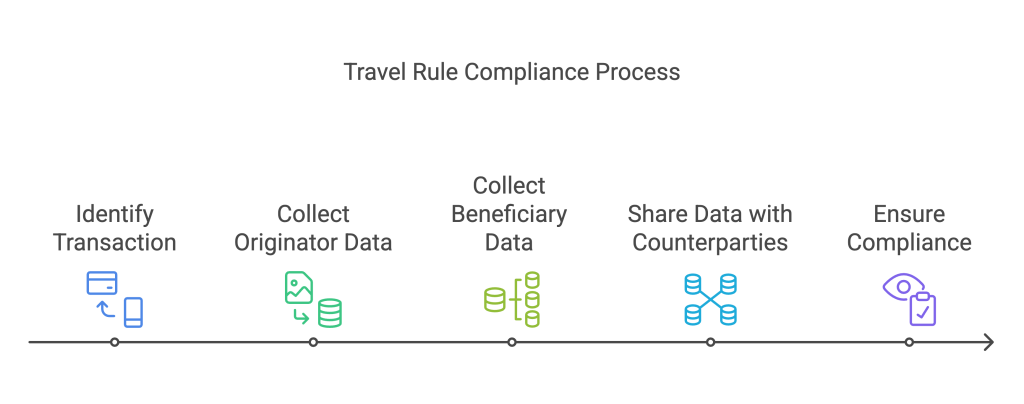

Here’s a quick rundown:

- Main Objective: To prevent money laundering and terrorism financing by maintaining a secure information trail of transactions.

- Key Requirement: Collect accurate data on both the sender and recipient of funds in transactions above a certain threshold.

- Information Sharing: Ensure this data is shared with counterparty VASPs or financial institutions during or before the transaction takes place.

Understanding and complying with the Travel Rule is crucial for any VASP. It helps maintain trust and integrity in the financial system by ensuring that all transactions are traceable and accountable. This rule plays a significant role in the regulatory framework that VASPs must navigate to operate legally and securely. It’s a cornerstone of compliance for the crypto industry, impacting how businesses handle digital assets globally.

Entities Required to Comply with the Travel Rule

The Travel Rule isn’t just something to know about; it’s a must-follow for Virtual Asset Service Providers (VASPs): This includes any entity involved in the exchange, transfer, or custody of virtual assets. That’s where our expertise at CryptoSwift really shines.

For VASPs, including exchanges and digital asset platforms, the Travel Rule means being ready to collect and share info about transaction originators and beneficiaries. This applies when transactions hit certain thresholds. In the European Union, under the MiCA regulation, there is a 0 EUR threshold, meaning all transfers are subject to the Travel Rule, regardless of the transaction amount. Meanwhile, the FATF recommends a lower threshold of $1,000 USD/EUR for its member countries. For further insights into navigating these regulatory challenges, our post on overcoming the Travel Rule challenges for VASPs provides a detailed look at the complexities involved and how to address them.

These requirements ensure that all transactions are not only tracked but also transparent and accountable. Compliance is crucial for maintaining trust and integrity in the financial system. For VASPs, it’s about more than just obligation; it’s about securing your operations and building a reputation in the digital asset world.

Key Requirements for Compliance

The Travel Rule sets out specific operational and data requirements for Virtual Asset Service Providers (VASPs) to ensure compliance. Understanding what needs to be collected, maintained, and shared is crucial for seamless operations.

Compliance starts with gathering detailed information about both the originator and the beneficiary of a transaction. This data is essential for creating a transparent and traceable trail of financial activities. The information must be meticulously documented and securely maintained for a minimum of five years.

Here’s what needs to be collected:

- Originator’s Details: Full name, account number, address, and any unique identifiers such as wallet addresses or transaction reference numbers.

- Beneficiary’s Details: Full name, account number, and any additional identifiers necessary for the transaction.

- Institutional Information: Names and identifiers of both the originator’s and beneficiary’s financial institutions.

This data isn’t just for internal records; it must be shared with counterparties involved in the transaction. However, it isn’t typically required by government bodies unless a Suspicious Activity Report is necessary.

Ensuring secure data handling is vital. This is where our expertise at CryptoSwift comes in. We provide a robust solution with secure data protocols, enabling VASPs to meet these compliance requirements effortlessly. Our platform is designed to integrate seamlessly, preserving your existing workflows while ensuring you stay compliant with global regulations. For more detailed information on how our platform can facilitate your compliance needs, explore our end-to-end Travel Rule compliance solution, which offers features like a secure REST API, real-time transaction monitoring, and comprehensive documentation.

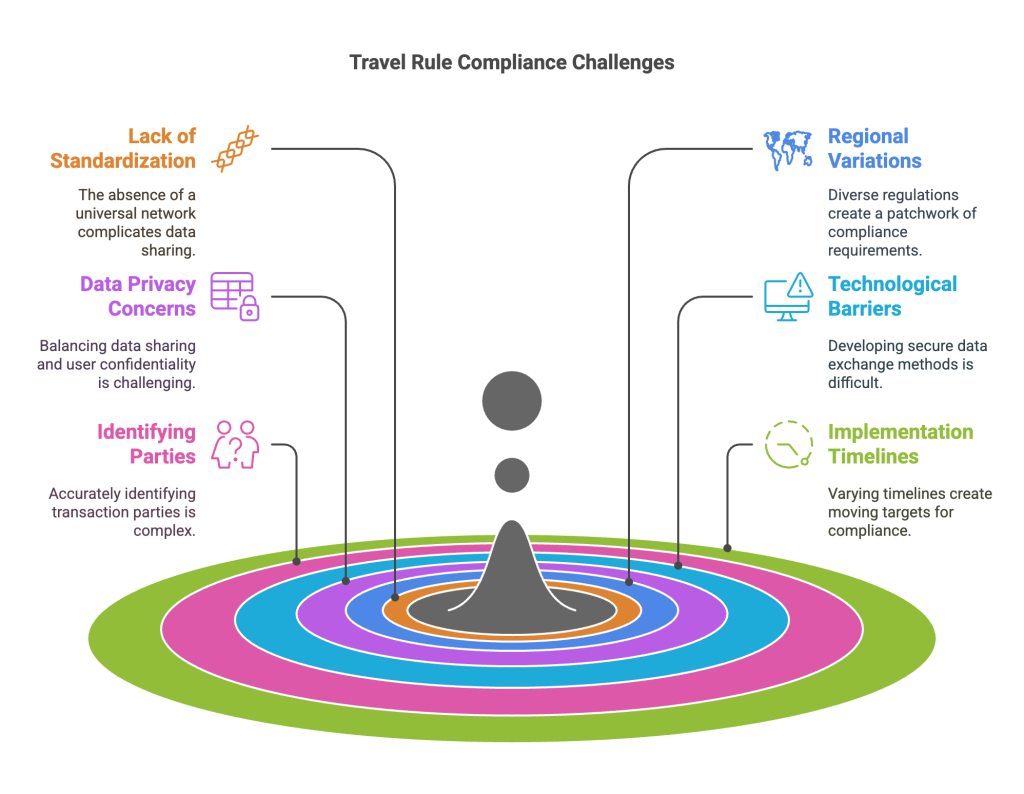

Challenges in Implementing the Travel Rule

Implementing the Travel Rule can be a real headache for VASPs and other financial institutions. There are a bunch of hurdles that make compliance tricky. One major issue is the absence of a universal network for sharing transaction data, similar to what SWIFT offers in traditional banking. This lack of standardization forces VASPs to rely on different protocols and solutions, adding a layer of complexity.

Regional regulations also vary widely, requiring VASPs to navigate a patchwork of rules. This means what works in one jurisdiction might not fly in another, making it tough to create a one-size-fits-all solution.

Here’s a closer look at some specific challenges:

- Data Privacy Concerns: Ensuring data privacy while complying with the Travel Rule is a balancing act. VASPs need to share enough information to meet regulatory standards without compromising user confidentiality.

- Technological Barriers: Finding or developing the right technology to securely exchange data between counterparties is tough. Without a standardized protocol, VASPs must adopt or create new methods for safe data sharing.

- Identifying Parties: Accurately identifying both the originator and beneficiary in transactions can be challenging, especially when dealing with self-hosted wallets or anonymous transactions. For more insights on how self-hosted wallets are affected by these regulations, you can explore our detailed analysis on MiCA and the Travel Rule.

- Implementation Timelines: Different regions have varied timelines for implementing the Travel Rule, causing a moving target for compliance efforts. To stay ahead of these timelines and ensure you’re prepared, consider reviewing our guide on getting ready for MiCA and the Travel Rule.

CryptoSwift addresses these challenges with an open-source protocol and seamless API integration, making it easier for VASPs to stay compliant across different jurisdictions. By leveraging our network of identified VASPs, we help streamline the compliance process, tackling these obstacles head-on.

Technological Solutions for Compliance

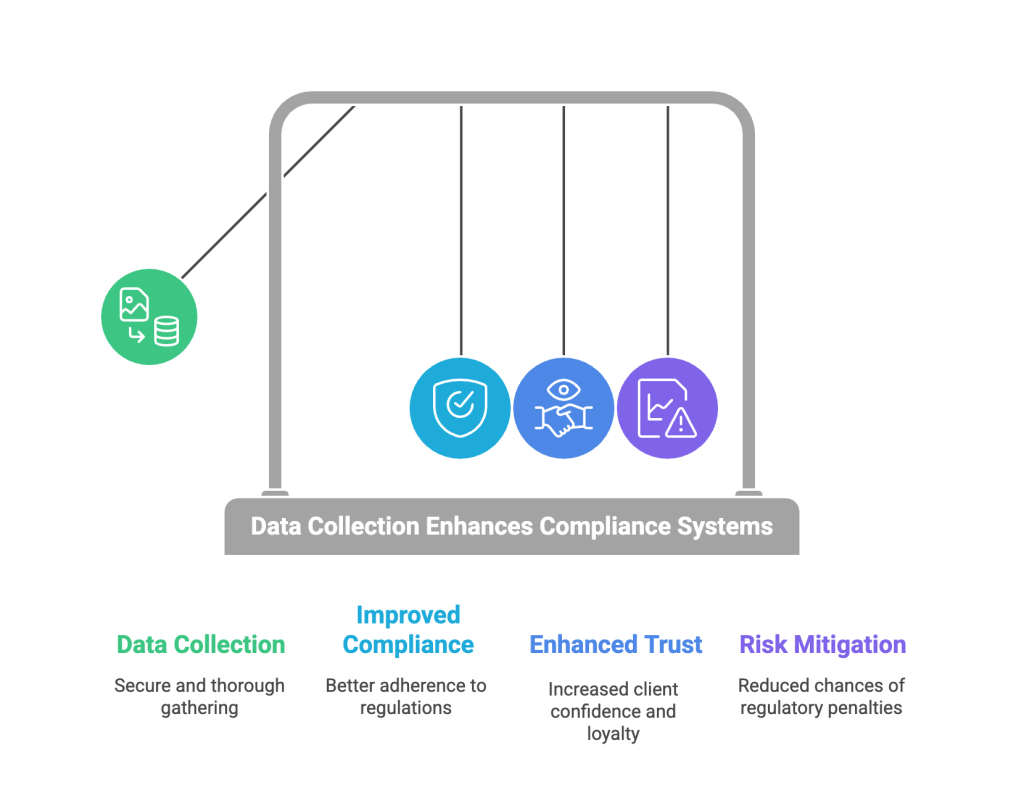

Technological solutions are vital for VASPs aiming to meet Travel Rule compliance. They simplify the complex task of securing, collecting, and transmitting data. These tools offer various capabilities, from encrypted data transfers to seamless communication networks.

The right technology can transform compliance into a streamlined process. There are different protocols available on the market for encrypted data transfers (STRIP, OpenVASP and TRISA among others). They enable secure collection and sharing of required information between VASPs and financial institutions. These technologies ensure compliance with the Travel Rule’s stringent requirements.

Blockchain analysis tools also play a role. They help verify transaction parties, ensuring adherence to AML/CFT requirements. These solutions provide the transparency needed for regulatory compliance.

From end-to-end Travel Rule compliance solutions, CryptoSwift stands out with its secure REST API and open-source STRIP protocol. This offers a seamless integration into existing workflows, ensuring compliance without disruption. Our network of over 1,000 identified VASPs provides extensive coverage for regulatory adherence. For those interested in understanding the regulatory landscape, our Travel Rule Archives offer a wealth of articles covering essential aspects of compliance and challenges associated with the Travel Rule.

Regional Variations in Travel Rule Compliance

Different jurisdictions have their own take on the Travel Rule, adapting it to fit local regulations. This means that VASPs must be aware of regional differences to stay compliant. The way the Travel Rule is implemented can vary widely across the globe.

In the European Union, the Travel Rule is integrated into the broader cryptocurrency regulations under the Markets in Crypto-Assets (MiCA) framework. The EU mandates strict compliance and sets specific thresholds for transactions, ensuring detailed data collection and sharing. For more insights on how the MiCA framework affects the Travel Rule, explore our detailed discussions on MiCA regulations and their implications.

In the United States, the Travel Rule is enforced through the Financial Crimes Enforcement Network (FinCEN). The U.S. has established a $3,000 threshold for transaction reporting, requiring VASPs to collect and share originator and beneficiary information. This aligns with its broader efforts to combat financial crimes.

South Korea has adopted its own approach, focusing on stricter data requirements and lower thresholds for compliance. The country has been proactive in regulating the crypto space, implementing rules that prioritize transparency and security.

Here’s a snapshot of how different regions approach the Travel Rule:

- European Union: Integrated within MiCA, requiring comprehensive compliance for VASPs.

- United States: Enforced by FinCEN with a $3,000 reporting threshold.

- South Korea: Prioritizes stringent data requirements and lower thresholds.

These variations highlight the need for VASPs to tailor their compliance strategies according to the specific regulatory demands of each region. For more information on navigating these challenges, you can review our Travel Rule insights and updates.

Comparison of FATF and US FinCEN Travel Rules

The FATF and US FinCEN have distinct approaches to the Travel Rule. Both aim to prevent financial crimes, but they differ in thresholds and enforcement.

The FATF sets a recommended threshold of $1,000 USD/EUR for applying the Travel Rule. This recommendation is advisory, allowing member countries to adapt it based on local needs. FATF’s guidelines focus on ensuring global consistency in anti-money laundering and counter-terrorism financing efforts. For a deeper understanding of how the FATF Travel Rule integrates with EU’s MiCA regulation, especially concerning self-hosted wallets, you can explore our detailed discussion on MiCA and the Travel Rule.

In contrast, the US FinCEN enforces a mandatory threshold of $3,000 for domestic transactions. There’s a proposal to lower this to $250 for international transfers. FinCEN’s rules are legally binding and come with specific enforcement mechanisms. This makes compliance non-negotiable for US-based VASPs.

Here’s a quick look at the key differences:

- Threshold:

- FATF: $1,000 USD/EUR (advisory)

- US FinCEN: $3,000 USD (mandatory), with a possible $250 threshold for international

- Nature:

- FATF: Advisory, adaptable by member countries

- US FinCEN: Mandatory national regulation

- Enforcement:

- FATF: Recommendations for global consistency

- US FinCEN: Specific enforcement measures

Understanding these differences is crucial for VASPs operating across jurisdictions. Compliance strategies need to align with both global recommendations and specific national regulations. To navigate these complexities, our insights on overcoming Travel Rule challenges provide valuable guidance for VASPs.

Best Practices for Achieving Compliance

Achieving compliance with the Travel Rule involves strategic planning and consistent effort. For Virtual Asset Service Providers (VASPs), navigating these regulatory waters requires a proactive approach. Here are some best practices to ensure you’re on the right path.

- Stay Informed: Keep up with the latest regulatory updates from bodies like FATF and local authorities. Understanding changes in compliance requirements helps you stay ahead.

- Implement Robust Data Collection: Gather all necessary data about transaction parties. Use secure methods to ensure the integrity and confidentiality of the information collected.

- Use Reliable Technology: Invest in a compliance solution that integrates seamlessly with existing systems. Look for platforms offering secure APIs and open-source protocols to ease data sharing.

- Conduct Regular Audits: Schedule regular compliance audits to identify gaps in your processes. This helps in maintaining adherence to the Travel Rule and preparing for any regulatory inspections.

- Train Your Team: Ensure your team is well-versed in compliance protocols. Regular training sessions can help staff understand the importance of data accuracy and secure handling.

- Engage with Compliance Experts: Collaborate with experts who can provide insights and guidance on best practices. This can be especially helpful when dealing with complex regulatory environments.

- Monitor Transactions in Real-Time: Use systems that offer real-time monitoring and alerts. This allows for immediate action in case of discrepancies or suspicious activities.

- Protect Data Privacy: Balance compliance with privacy by implementing measures that protect user data while meeting regulatory obligations. This builds trust with your clients.

Following these practices not only helps in achieving compliance but also strengthens your operational integrity. By adopting these strategies, VASPs can ensure smooth, secure, and compliant transactions, fostering trust in the digital asset ecosystem.

The Importance of Travel Rule Compliance Solutions

Effective compliance solutions are vital for VASPs navigating the complex landscape of the Travel Rule. These solutions ensure secure transactions, aligning with global regulations and maintaining trust in the financial system. They provide the necessary tools to manage data efficiently, adhering to standards like FATF Recommendation #16 and the EU’s MiCA.

CryptoSwift stands out by offering an end-to-end compliance platform designed specifically for VASPs. Our solution not only integrates seamlessly with existing systems but also addresses key challenges like data privacy and technological barriers. The open-source STRIP protocol and secure REST API make compliance straightforward and efficient.

Here’s what we’ve covered:

- Essential Compliance: Meeting Travel Rule requirements is non-negotiable for VASPs to operate legally and securely in the crypto space.

- Data Management: Gathering and sharing detailed information about transaction parties is crucial for transparency and accountability.

- Technological Integration: Using reliable tech solutions like CryptoSwift’s seamless API ensures compliance without disrupting current workflows.

- Regional Adaptation: Understanding and adapting to regional regulatory variations is necessary for global operation.

- Overcoming Challenges: CryptoSwift addresses issues like data privacy and regulatory uncertainty, simplifying the compliance process.

These solutions are not just about meeting requirements; they are about safeguarding operations and maintaining integrity in the digital asset industry. With reliable compliance tools, VASPs can ensure their transactions are secure and adhere to global standards.