Crypto Travel Rule compliance solution

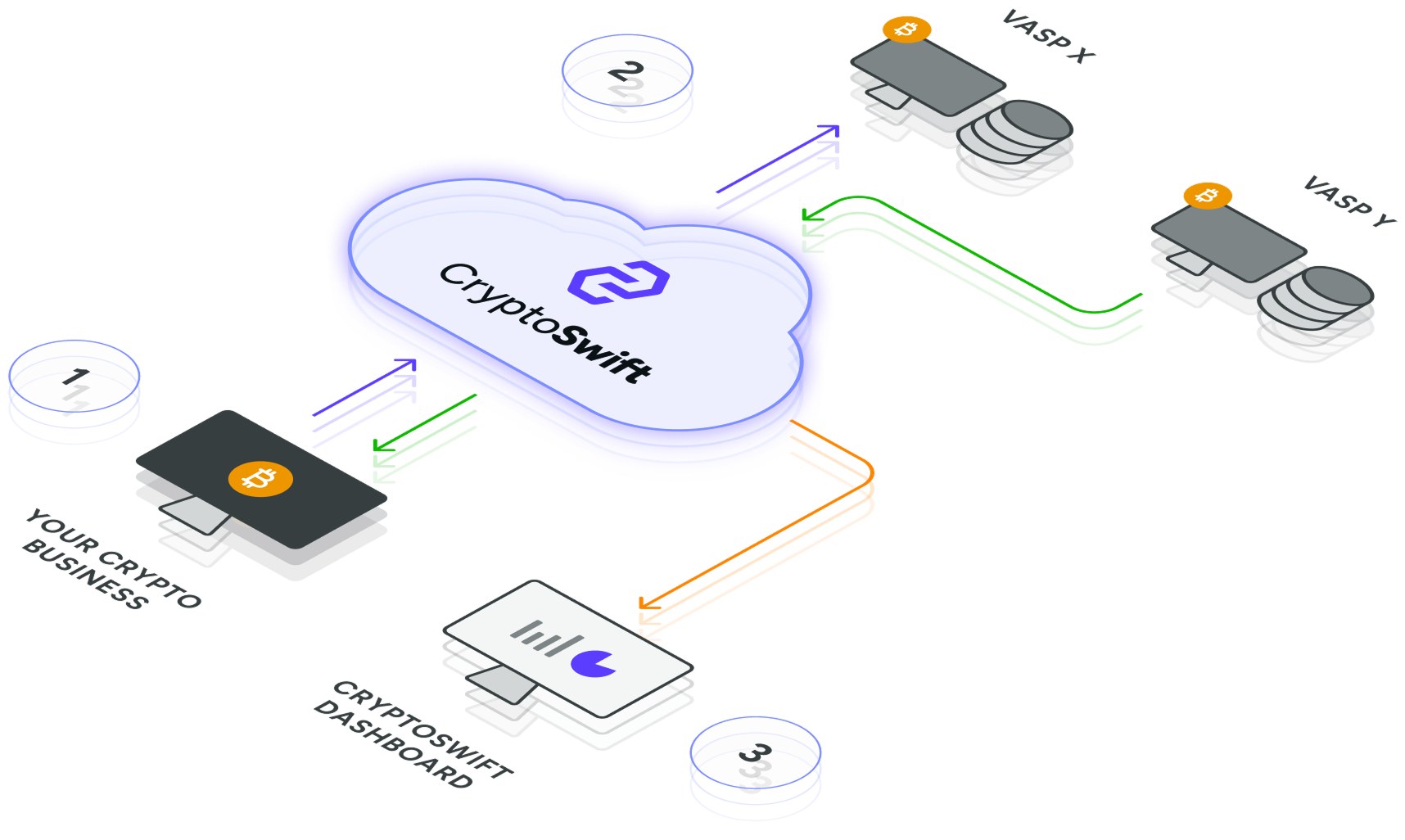

CryptoSwift is an end-to-end Travel Rule compliance solution, that is designed to help Virtual Asset Service Providers (VASPs) meet regulatory requirements with ease, ensuring secure and compliant transfers of digital assets.

Integrate with CryptoSwift and start sending Travel Rule Data via our API

CryptoSwift takes care of delivering your messages and forwarding incoming messages from other VASPs

Track and monitor your transactions using the CryptoSwift client dashboard.

Trusted by crypto companies worldwide

Reliable Infrastructure for Travel Rule Compliance

CryptoSwift offers a robust infrastructure and tools designed to manage the delivery of your Travel Rule messages and seamlessly forward incoming communications from other VASPs. At the core of our solution is a powerful, easy-to-integrate API.

CryptoSwift comes with

- Secure and easy-to-use REST API

Designed to streamline your Travel Rule compliance effortlessly. Our API ensures that your data is protected with top-tier security protocols, giving you peace of mind while handling sensitive information. - Extensive API documentation and developer guides

All the necessary information to help you get started quickly and efficiently. Whether you’re a seasoned developer or new to API integrations, we will guide you through every step of the process. - Client Dashboard

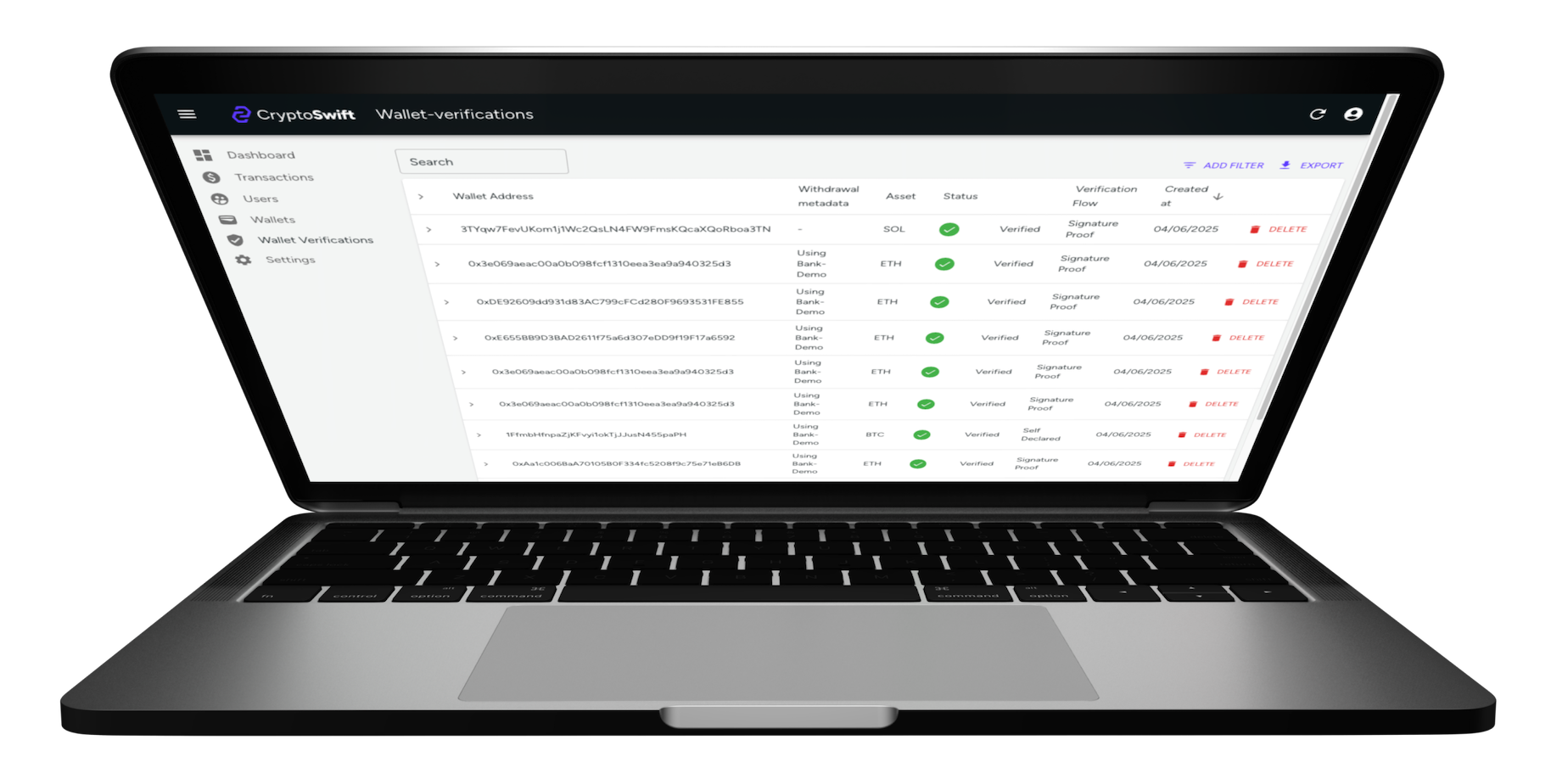

View transaction history, monitor transaction statuses in real-time and set up custom notifications. - Self-Hosted Wallet Verification

Easily verify wallet ownership with our self-hosted wallet verification widget or API. Simple, secure, and customizable to fit your needs. - Individual Customer Support

Guided onboarding process & support for smooth integration, setup and troubleshooting.

The simplest API-driven solution for Travel Rule compliance

Compliance Made Simple, Security Built In

Your business comes first

CryptoSwift does not interfere with your existing business logic. Our API is built for seamless integration, allowing you to maintain your current workflows without disruption. Experience hassle-free compliance with the CryptoSwift API and keep your focus on what matters most – your business.

Uncompromised Security

Protect sensitive transaction data with top-tier security protocols, all managed securely by CryptoSwift.

CryptoSwift client dashboard

Stay in Control of Your Travel Rule Transactions

- Real-Time Monitoring

Track your outgoing and incoming Travel Rule transactions in real-time and receive instant notifications of status updates. - Overcome Travel Rule’s “sunrise” challenge

Send and receive data transfers from and to any counterparties, even if they don’t have Travel Rule solution in place. - Historic transaction lookup

Ability to see any transaction of VASP broadcast to CryptoSwift even before integration date.

Wallet verification widget

The easiest way to validate self-hosted wallets

Our widget makes verifying self-hosted (non-custodial) crypto wallets straightforward and adaptable to your workflows. It supports all major wallets and verification scenarios, including cryptographic signature proofs (QR codes), Satoshi tests, visual proof, and self-declaration.

You can either use the widget as a stand-alone tool (redirect your users and bring them back when done) or embed it directly into your web application as a Web Component. All widget features are fully available through our API, giving you complete flexibility to integrate wallet verification exactly how you need it.

Built for developers

Deliver faster with APIs designed for simplicity and efficiency

Save valuable engineering time with a unified Travel Rule solution. We navigate the complexities of diverse blockchains, wallets, and networks across the global crypto ecosystem, so you can stay focused on growing your business.

Open-source Travel Rule protocol

The CryptoSwift API is based on our open-source protocol called STRIP (Simple Travel Rule Information Protocol). STRIP is fully compatible with major Travel Rule regulations, including FATF Recommendation #16 and the MiCA Transfer of Funds Regulation.

curl --location --request POST 'https://api.cryptoswift.eu/transactions' \

--header 'x-api-key: a70fcedf-416b-4f83-845c-a05aba0d7da4' \

--header 'Content-Type: application/json' \

--data-raw '{

"asset": "BTC",

"amount": "0.00341",

"blockchainInfo": {

"origin": "0xb794f5ea0ba39494ce839613fffba74279579268",

"destination": "0x71C7656EC7ab88b098defB751B7401B5f6d8976F"

},

"originator": {

"name": "Marwin Hillar",

"accountNumber": "04143282398",

"address": "Alexanderplatz 25, Berlin",

"country": "Germany"

},

"beneficiary": {

"name": "Hanne Nikol",

"accountNumber": "AB54234232"

}

}' Frequently Asked Questions

What is the Crypto Travel Rule?

The Crypto Travel Rule, introduced by the Financial Action Task Force (FATF), requires Virtual Asset Service Providers (VASPs) to share specific customer information when transferring virtual assets between entities. This rule aims to combat money laundering and terrorist financing by improving transparency in crypto transactions.Who must comply with the Travel Rule?

VASPs, including cryptocurrency exchanges, wallet providers, and financial institutions handling virtual asset transactions, must comply. Compliance depends on the jurisdiction, but it generally applies to entities transferring cryptocurrencies above a specific threshold. In the European Union, under the MiCA regulation, there is a 0 EUR threshold, meaning all transfers are subject to the Travel Rule, regardless of the transaction amount.What customer information must be shared under the Travel Rule?

Under the Travel Rule, VASPs must transmit the following information for transactions:-

- Originator Information:

-

- Name

-

- Account number (or unique transaction identifier)

-

- Physical address or national identity number (depending on jurisdiction)

-

- Originator Information:

-

- Beneficiary Information:

-

- Name

-

- Account number (or wallet address)

-

- Beneficiary Information:

How does the Travel Rule impact crypto exchanges and banks?

-

- Data Collection: Ensuring accurate customer information is collected during onboarding and transactions.

-

- Secure Transmission: Exchanging customer information securely between counterparties.

-

- Transaction Monitoring: Identifying and flagging suspicious transactions for further investigation.

What are the technical challenges of implementing the Travel Rule?

-

- Interoperability: Ensuring compatibility between various Travel Rule protocols.

-

- Data Privacy: Balancing regulatory compliance with customer data protection requirements under GDPR or similar regulations.

-

- Real-Time Compliance: Transmitting data in real time without impacting transaction speed or user experience.

-

- Counterparty Verification: Ensuring the receiving VASP is legitimate and compliant.

What solutions does CryptoSwift.eu offer for Travel Rule compliance?

-

- Interoperable Protocols: Seamless integration with leading Travel Rule networks and protocols. Integrate once and we do the rest.

-

- Data Encryption: End-to-end encrypted data transmission to protect sensitive customer information.

-

- Real-Time Processing: Ensuring rapid, secure exchange of required data without transaction delays.

-

- Regulatory Expertise: Up-to-date compliance with evolving FATF guidance, MiCA regulations, and regional differences.

Is the Travel Rule only for international transactions?

What is the threshold for Travel Rule applicability?

Does the Travel Rule apply to DeFi transactions?

How does the Travel Rule align with GDPR and data privacy laws?

-

- Minimizing the data collected and transmitted.

-

- Using encryption to secure sensitive information.

-

- Adhering to jurisdictional privacy laws while maintaining transparency for regulators.

What protocols are available for Travel Rule compliance?

How can I start implementing the Travel Rule in my organization?

-

- Conduct a gap analysis of your current compliance processes.

-

- Choose a Travel Rule solution provider, like CryptoSwift.eu, that aligns with your operational needs.

-

- Integrate the chosen protocol into your transaction workflows.

-

- Train your compliance and technical teams on the new processes.

-

- Monitor and adapt to regulatory changes.

How can CryptoSwift.eu help me stay ahead of regulatory changes?

Can I test CryptoSwift.eu’s Travel Rule solution before full integration?

-

- Simulate Travel Rule transactions.

-

- Validate data security and accuracy.

-

- Ensure interoperability with counterparties before live deployment.